Need Help?

For Enquiry

+852 2531 0333

Email Us

cs_web@zerofinance.hk

Service hour

Mon – Fri: 9:00-18:00

Sat, Sun and public holidays closed

Warning:

You have to repay your loans. Don’t pay any intermediaries.

Zero is the foundation that drives

greater values

Zero Finance will continuously introduce smart and personalized financial products, achieving a flexible and reliable technology-driven integrated platform for the public.

Zero Finance is a financial technology company aimed to provide to the public a zero limit, zero wait, and zero pain financial service. Founded in 2014, Zero Finance focuses on inclusive finance and wealth management businesses.

We always believe any loan products should be designed with simplicity and helpfulness. Human approval gives bias results, ignoring important factors that could impact the approval result of a applicant.

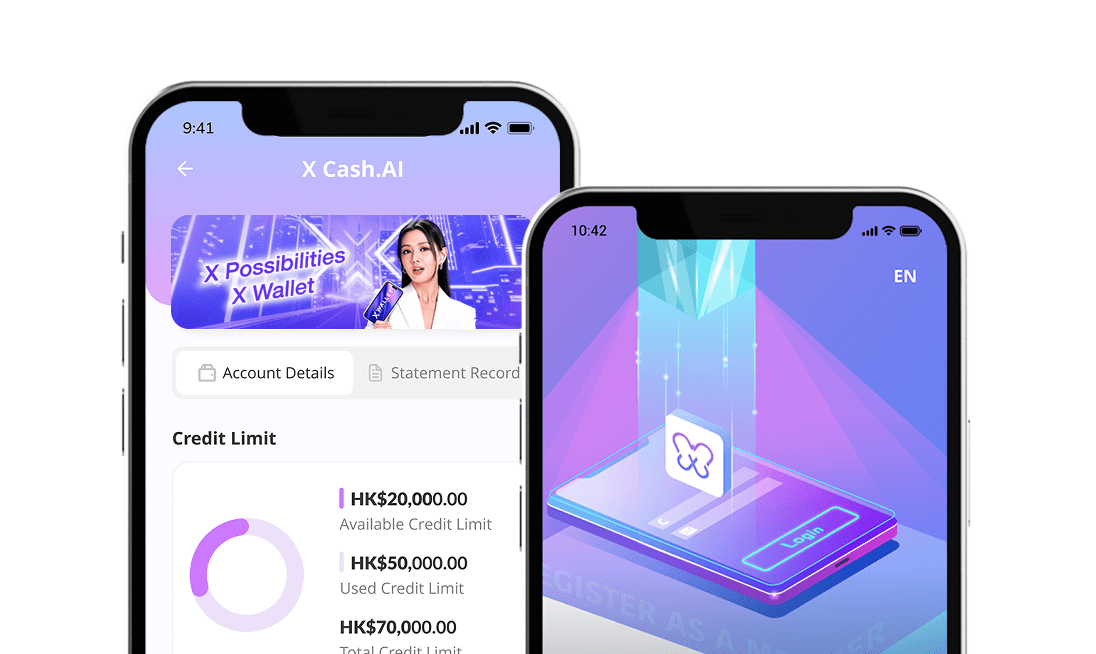

X Wallet breaks the traditional way of lending using Machine Learning and data analysis to deliver an automated borrowing process in 3 easy steps.

“Popular Money-Lending Mobile Apps” Awards

X8 Finance and Zero Finance are subsidiaries of Zero Fintech Group Limited (Stock Code: 0093), X8 Finance holds a Hong Kong money lender license (0676/2024), mainly engages in property loan business in Hong Kong, and provides customers with low-interest and reliable loan solutions.

Zero Finance is a subsidiary of Zero Fintech Group Limited

(Hong Kong Stock Exchange No.0093), a credit company with money lender license in Hong Kong. As a member of the Hong Kong Finance Professional Association, Zero Finance is devoted to lead the financial and loan industry with technology, and providing reliable and diversified financial products to public .

Money Lender’s License: 0954/2024

For Enquiry

+852 2531 0333

Email Us

cs_web@zerofinance.hk

Service hour

Mon – Fri: 9:00-18:00

Sat, Sun and public holidays closed

Warning:

You have to repay your loans. Don’t pay any intermediaries.

Scan QR Code to

Download APP

GET THE APP

The minimum and maximum repayment period is 12 months and 72 months respectively.

The Minimum annual percentage rate is 12% and maximum annual percentage rate is 48%

A representative example of total cost for a loan below is for reference only:

Loan mount:HK$10,000

Monthly instalment of HK$889 for 12 months

Monthly interest rate: 0.55%

Annual interest rate: 12%

Total repayment amount: HK$10,688

According to user Lynn’s sharing, briefly describe her loan information:

The shortest repayment period starts from 61 days and the longest is 48 months.

Effective annual interest rate: 8%

Interest rate: 0.67% monthly

Loan amount: $15,000

A 48-month installment loan with a monthly repayment: $50

Total repayment: $17,400

The above loan-related fees are for reference only

Actual annual interest rate is from 8% to 48% as maximum.

According to user Lynn’s sharing, briefly describe her loan information:

The shortest repayment period starts from 61 days and the longest is 48 months.

Effective annual interest rate: 8%

Interest rate: 0.67% monthly

Loan amount: $15,000

A 48-month installment loan with a monthly repayment: $50

Total repayment: $17,400

The above loan-related fees are for reference only

Actual annual interest rate is from 8% to 48% as maximum.